The big hot button issue in Ohio’s upcoming November election is … Property Taxes! The dramatic increase in home value over the past 10 years has lead to a similarly shocking increase in property taxes. Combined with the overall increase in cost-of-living and stagnation of wages/benefits for seniors this has lead to a serious cash crunch.

As a result Ohio legislators have proposed a large number of changes to property taxes, some of which were signed into law. At the same time, a group of Ohioans decided they wanted to eliminate property taxes entirely and have been working to get an amendment to the Ohio Constitution on the November ballot. They are still working to collect the required number of signatures, but there is a strong expectation that this issue will make it to the November ballot.

Want to hear from the experts?

Do you want to learn about how property taxes are used and how changes could impact our public services, schools and Geauga County? The League of Women Voters of Geauga is hosting a nonpartisan, moderated question and answer session at the Bainbridge Library!

When: Wednesday, February 25, 2026 | 6:30 to 8:00 pm

Where: Bainbridge Library - 17222 Snyder Rd., Chagrin Falls, OH

Registration is required so signup here.

The history of taxes in Ohio

Historically, Ohio relied almost exclusively on property taxes. It wasn’t until the mid-20th century that sales and income taxes were introduced to relieve the burden on property owners and provide more stable revenue for a growing state.

Property Tax: The Foundation (1803–Present)

Property tax is Ohio’s oldest tax, predating statehood. In the early 1800s, it was the primary way the government funded itself.

1803–1825: Ohio taxed land based on its fertility (1st, 2nd, or 3rd rate).

1825: The state shifted to an ad valorem system, meaning taxes were based on the property's market value rather than just the soil quality.

1851: The new State Constitution required property to be taxed by a uniform rule, ensuring fairness across different types of land.

1930s (The Great Depression): Massive defaults led to the "10-mill limit." This prevents local governments from taxing more than 1% of a property's value without a direct vote from the people.

1976 (House Bill 920): This is a critical point in history. HB 920 was passed to stop "stealth" tax increases. It freezes the amount of money a school or library gets from a specific levy, even if home values go up. If property values rise, the tax rate is automatically lowered to keep the dollar amount the same.

Sales Tax: The Emergency Measure (1935)

Before 1935, Ohio had no state sales tax. The Great Depression changed that (due to deficits created by massive number of property tax defaults)

1935: To fund emergency poor relief and schools during the Depression, Ohio implemented a 3% "temporary" sales tax.

1967: The rate was increased to 4%, and for the first time, counties were allowed to add their own "piggyback" sales taxes.

Modern Day: The state rate is currently 5.75%, but with local county additions, most Ohioans pay between 6.5% and 8%.

Income Tax: The Modern Era (1971)

Ohio was relatively late to the income tax game. For over 150 years, the state avoided it.

1912: A constitutional amendment was passed specifically to allow for a graduated income tax, but the legislature didn't act on it for decades.

1971: Under Governor John Gilligan, the state finally enacted a personal income tax to address a massive budget deficit and school funding crisis.

2005–Present: Recent decades have seen a push to reduce or "flatten" the income tax. In 2025, Ohio officially shifted toward a flat tax structure, moving away from the complex brackets of the 1970s. In 2026 we will have a flat tax with a rate of 2.75%

Who in Ohio can impose various taxes

Not every level of government is able to impose any kind of tax. Ohio state law is very specific about who is allowed to tax, what taxes they are allowed to impose, and the maximum level of those taxes. The following table is for 2025.

Government Entity | Property Tax | Sales Tax | Income Tax | Other Taxes |

State of Ohio | No* | 5.75% | Yes | Commercial Activity Tax (CAT), Gas, Cigarette |

Counties | Yes | Up to 1.5% | No | Lodging, Real Estate Transfer fees |

Municipalities | Yes | No | Up to 3% | Admissions, Parking, Bed taxes |

Townships | Yes | No | No | Lodging (limited) |

School Districts | Yes | No | Yes** | — |

*The state stopped levying a general property tax in the early 20th century, though it still oversees the rules for how local governments collect it. **Only with voter approval; not all school districts have an income tax.

Impact on Bainbridge Township

If property tax is eliminated then townships in Ohio are going to be the most impacted. As you can see in the above chart, property tax is the only way for townships to generate revenue.

Without property tax, townships have no revenue generating mechanism.

Today, townships pay for fire, EMS, police, roads, zoning, and parks/recreation. In 2025 Bainbridge Township had revenue of nearly $18.8M, of which $13.9M (74%) came from property taxes. Total expenses for 2025 came to $18M.

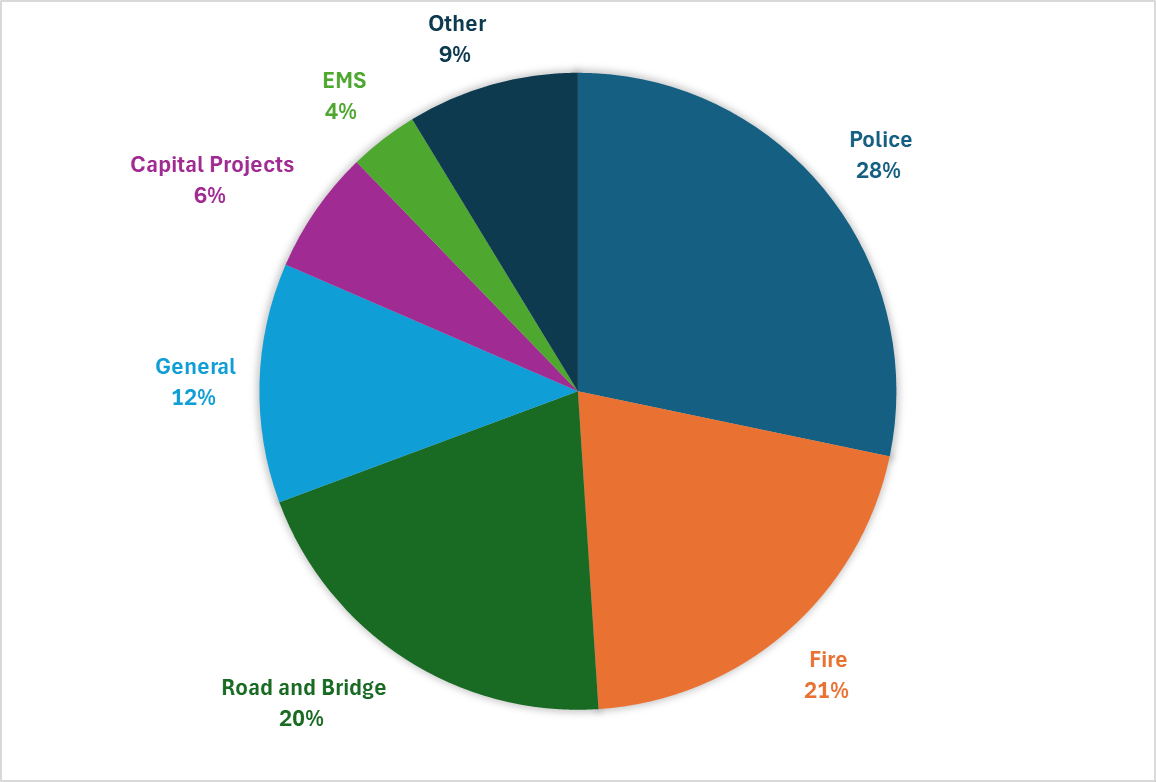

Breaking down the township’s expenses below, we see that Police, Fire, and Roads account for 69% of the total expenditures.

2025 Bainbridge Township expenditures per category

Impact on Geauga County

Basically, Geauga can, under the current rules, impose a 1.5% sales tax on all taxable purchases made in the county. As of 2025, the county already levies a 1% sales tax. In 2023, the latest year available, the county had approximately $72.86M in total general revenue of which $33.2M was from property tax, $22.4M from sales tax, and then 17.3M from a mixture of grants, investment earnings, and vehicle tax.

Assuming that an increase in sales tax rate (from 1% to 1.5%) does not change shopping patterns, then Geauga would bring in approximately $33.6M from sales tax. The increase of $11.2M would offset only 1/3 of the loss of the property tax (net loss of $22.4M).

In 2025, Geauga had a total revenue of $110.7M and total expenses of $105.6M. Expenses break down as:

Program Expenses for Geauga County in 2023

To makeup the shortfall, the county would have to cut 21% of expenses.

Impact on Ohio

Ohio’s revenue will not be impacted by loss of property tax as the state no longer utilizes that tax.

Impact on Ohio’s Schools

The amount of money that each school district gets from the State varies with the annual state budget and is based on a complicated and subjective set of metrics. Basically, the more the school gets from property taxes, the less they will get from the state in future years.

If you look at a school like Kenston, the school gets 75% of it’s revenue from property taxes. That is a $33.2M gap that would be created against an operating budget of $43.7M and outstanding obligations of $23.2M.

The Treasurer, Seth Cales, has stated that the district would run out of cash by April 2027 if property taxes are eliminated and no alternative plan is put into place.

The other piece of this to consider is that Ohio funds to school districts are computer “per pupil”. At the same time, there is a significant effort by the Statehouse to push students into private schools using public funds. Vouchers are available for every student in Ohio, regardless of income. The state spent $731M in the 2023/24 school year to enable approximately 65,000 students to go to private schools. Each time one of these students leave their home public school, the number of pupils drops resulting in lower state funding to that district.

Where do we go from here?

While there is plenty of fear mongering out there, if this amendment gets enough signatures to get on the ballot and it gets approved it will start the clock on politicians across the spectrum to develop a solution. The amendment as written would go into effect on Jan 1, 2027. This means that the typical February property tax bill would not occur and the governmental entities would start to feel the pain from the lack of cash.

It is clear that the current lame-duck governor and Statehouse don’t want to implement any further changes to the property tax situation prior to the November election. Statehouse representatives will take office on Jan 1, 2027. The new governor will take office on Jan 11. This gives the new state government less than two months to act. Which is frankly not likely. In effect, we can with high confidence expect the February property tax bills to not be paid out.

Gubernatorial candidate Vivek Ramaswamy has made it clear that his plan is to eliminate the Ohio income tax (in a gradual manner).

"There are ways to get there that don't necessarily require raising the sales tax particularly,"

He has also stated that he believes that if the property tax is eliminated it can be managed by reducing the size of state government. He has not stated anything (that I can find) about how the impact on county, local, or schools would be managed.

Democrat candidate Amy Acton has stated she doesn’t see a need to raise income taxes, rather the budget priorities need to be changed. Her platform focuses on targeted relief rather than total elimination. She supports measures like expanding the Homestead Exemption and implementing a "circuit breaker", a mechanism that provides state-funded tax credits to low- and middle-income residents when their property taxes exceed a certain percentage of their income.

Clearly the choice of new governor will have a significant impact on how the state responds to the people’s vote on the amendment.

What is the Homestead Exemption?

The Ohio Homestead Exemption acts as a targeted form of property tax relief by shielding a portion of a home's market value from taxation for qualifying seniors (age 65+) and permanently disabled individuals. For the 2026 tax cycle, the standard exemption shields $29,000 of market value from local property taxes, provided the homeowner’s Ohio Adjusted Gross Income does not exceed $41,000 (though residents who were enrolled prior to 2014 are "grandfathered" in regardless of income). A more robust "enhanced" exemption is available for 100% service-connected disabled veterans and surviving spouses of first responders killed in the line of duty, which shields $58,000 of value and carries no income restrictions. These amounts are now indexed to inflation annually due to recent legislative reforms (HB 33), thus the exemption will scale with the rising cost of living.

Options that don’t require Ohio law changes

Schools are allowed to put income tax levy’s on the ballot. It is hard to imagine that such a levy would be able to get on the May 2027 ballot, but it is possible. Regardless, any such levy would not go into effect until fall 2027 at the absolute earliest. Schools will have to find a way to scrimp and save until that point.

Counties can raise sales tax to the maximum 1.5%. But as seen from the example of Geauga county, that would leave the county in a $22M hole. 59 of Ohio’s 88 counties are already at the 1.5% limit and those counties would have no flexibility to respond without state-level changes.

Townships would basically be screwed. They would have to go ask the county for money, but the county is already in a massive hole so they have no money to spare. That means they would have to go to the state to try to get money to cover police, fire, EMS, etc. Most likely all non-life critical services would be immediately suspended and critical services cut back to an absolute minimum based on how much money the township has managed to save.

Municipalities would all increase their income tax to the 3% maximum. Like the counties, this would help, but would not cover the cuts required.

Long-term structural changes

I’m just going to hypothesize here because so much is up in the air at the moment. I do think the following are very possible - even likely - changes that would happen in Ohio over the 5-10 year horizon.

Townships would work to incorporate so as to be able to levy local income taxes.

Those localities that have professional fire departments will move to an all-volunteer force.

School districts will begin to consolidate into county-level schools. This is similar to what many states currently do (see Maryland, Virginia, North Carolina, Florida, West Virginia, Georgia, South Carolina, Alabama, Tennessee, Kentucky, Mississippi, Louisiana, Arkansas, Nevada, Alaska, and Utah). This would act to remove the local schools from the very direct supervision that we see today with a very local elected school board.

Cities will possibly start to combine to reduce the burden of maintaining services and administration on a small tax base.

County functions will migrate to the state. In particular I would expect many of the judicial and human services functions “outsourced” to the Ohio government

Some government services will be cut. There’s basically no other way out here.

Final thoughts

Well, this turned out to be a lot longer than I planned, but hopefully this information helps you understand how we got here and what things may look like across the state in a less than a year.

If nothing, this should highlight how critical it is for every person to be engaged in their government (at all levels). Ohio has elections coming up on May 5th, 2026 (primary election) and November 3rd, 2026 (general election). Please vote.

Title image is Property Tax by Nick Youngson CC BY-SA 3.0 Pix4free.org